Back كبار النفط Arabic غولهای نفتی Persian Supermajor French 슈퍼메이저 Korean Didžiausios pasaulio naftos bendrovės Lithuanian Empresa petrolífera internacional Portuguese Supermajor Swedish மாபெரும் எண்ணெய் நிறுவனங்கள் Tamil 石油巨头 Chinese

| Company | Revenue (USD)[3] | Profit (USD) | Brands |

|---|---|---|---|

| ExxonMobil | $286 billion | $23 billion | Mobil Esso Imperial Oil |

| Shell plc | $273 billion | $20 billion | Jiffy Lube Pennzoil Z Energy |

| TotalEnergies | $185 billion | $16 billion | Elf Aquitaine SunPower |

| BP | $164 billion | $7.6 billion | Amoco Aral AG |

| Chevron | $163 billion | $16 billion | Texaco Caltex Havoline |

| Marathon | $141 billion | $10 billion | ARCO[4] |

| Phillips 66 | $115 billion | $1.3 billion | 76 Conoco JET |

| Valero | $108 billion | $0.9 billion | — |

| Eni | $77 billion | $5.8 billion | — |

| ConocoPhillips | $48.3 billion | $8.1 billion | — |

Big Oil is a name sometimes used to describe the world's six or seven largest publicly traded and investor-owned oil and gas companies, also known as supermajors.[5][6][7][8] The term, particularly in the United States, emphasizes their economic power and influence on politics. Big Oil is often associated with the fossil fuels lobby and also used to refer to the industry as a whole in a pejorative or derogatory manner.[9]

Sources conflict on the exact makeup of Big Oil today, though the companies which are most frequently mentioned as supermajors are ExxonMobil, Shell, TotalEnergies, BP, Chevron and Eni, with ConocoPhillips frequently being included as well prior to spinning off its downstream operations into Phillips 66. The phrase "Super-Major" emanated from a report published by Douglas Terreson of Morgan Stanley in February 1998. The report foretold a substantial consolidation phase of "Major" Oil companies which would result in a group of dominant "Super-Major" entities. [10][11][12][13] Big Oil previously referred to seven oil companies which formed the Consortium for Iran; such "Seven Sisters" were the Anglo-Persian Oil Company (a predecessor of BP), Shell plc, three of Chevron's predecessors (Standard Oil of California, Gulf Oil and Texaco), and two of ExxonMobil's predecessors (Jersey Standard and Standard Oil of New York).

The term, analogous to others such as Big Steel, Big Tech, and Big Pharma which describe industries dominated by a few giant corporations, was popularized in print from the late 1960s.[14][15] Today it is often used to refer specifically to the seven supermajors.[16] The use of the term in the popular media often excludes the national producers and OPEC oil companies who have a much greater global role in setting prices than the supermajors.[17][18][19] China's two state-owned oil companies, Sinopec and the China National Petroleum Corporation, as well as Saudi Aramco, had greater revenues in 2022 than any investor-owned oil company.[20]

In the maritime industry, six to seven large oil companies that decide a majority of the crude oil tanker chartering business are called "Oil Majors".[21]

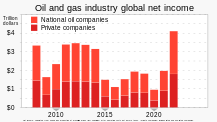

- ^ "World Energy Investment 2023" (PDF). IEA.org. International Energy Agency. May 2023. p. 61. Archived (PDF) from the original on 7 August 2023.

- ^ Bousso, Ron (8 February 2023). "Big Oil doubles profits in blockbuster 2022". Reuters. Archived from the original on 31 March 2023. • Details for 2020 from the more detailed diagram in King, Ben (12 February 2023). "Why are BP, Shell, and other oil giants making so much money right now?". BBC. Archived from the original on 22 April 2023.

- ^ "Fortune 500". Fortune. Retrieved 17 November 2022.

- ^ "Marathon Petroleum". Marathon Petroleum Corporation . Retrieved 26 October 2023.

- ^ "Oil majors' output growth hinges on strategy shift". Reuters. 1 August 2008. Archived from the original on 13 May 2012. Retrieved 28 April 2011.

- ^ "Shell will invest despite decline in earnings". The New York Times. 2 February 2006. Retrieved 28 April 2011.

- ^ "ConocoPhillips: The Making Of An Oil Major". Business Week. 12 December 2005. Retrieved 1 April 2016.

- ^ Nafta - Volume 56 - Page 447 2005 "Tom Nicholls, editor, Petroleum Economist, writes WHOEVER coined the term supermajor should have kept some superlatives in reserve. Oil companies may rank as some of the biggest private-sector corporations, but when it comes to oil ..."

- ^ Inside the Big Oil Game at Time

- ^ Högselius, Per (2018). "Energy and Geopolitics". Routledge. ISBN 9781351710282. Retrieved 9 July 2022.

In global oil parlance, it is common to talk about the" seven supermajors" comprising ExxonMobil, Chevron, ConocoPhillips, BP, Shell, Total and Eni.

- ^ Reynolds, Ben (9 June 2022). "The 6 Big Oil Supermajor Stocks Ranked From Best To Worst". Sure Dividend. Retrieved 1 September 2022.

- ^ OilNOW (29 August 2017). "The super-majors...what and who are they? | OilNOW". Retrieved 1 September 2022.

- ^ Herold, Thomas (3 March 2017). "What are the Big Oil Super Majors?". Herold Financial Dictionary. Retrieved 13 October 2022.

- ^ Corporate Packaging Management C. Wayne Barlow - 1969 "Even with the price ceilings, gas cost more than it had, prompting consumers to charge that “Big Oil,” and not the Arabs, had used the crisis to squeeze profits from oppressed consumers. Some thought that the oil companies got rich from the ..."

- ^ Defending the National Interest: Raw Materials Investments and ... - Page 330 Stephen D. Krasner - 1978 "Kennedy's Treasury Secretary, Douglas Dillon, was a director of Chase Manhattan Bank and thus tied to the Rockefellers and big oil. Nixon's campaigns were partly financed by oil money, and his Secretary of the Interior, Walter Hickel, was an ...

- ^ Encyclopedia of Business in Today's World: A - C - Volume 1 - Page 174 Charles Wankel - 2009 The older term Big Oil, used in reference to the cooperative behavior and lobbying of oil companies, is often used now to refer specifically to the supermajors. Each supermajor has revenues in the hundreds of billions of dollars, benefiting from ...

- ^ Green Energy: An A-to-Z Guide - Page 331 Dustin Mulvaney - 2011 "the oil majors have the power to manipulate oil prices, profiteering at the expense of consumers in North America and Europe. Although the term Big Oil is used in the media, it is not used to describe the Oil Producing and Exporting Countries'

- ^ Crude Reality: Petroleum in World History Brian C. Black - 2012 "Therefore, Big Oil included large-scale corporate infrastructure that spanned the globe without ever releasing the basic elements that titillated the public: fortune, danger, and bust. Today, the term Big Oil most likely evokes a negative visceral ..."

- ^ Role of National Oil Companies in the International Oil Market Robert Pirog - 2011 "In the United States, the term “big oil companies” is likely to be taken to mean the major private international oil companies, largely based in Europe or America. However, while some of those companies are indeed among the largest in the ..."

- ^ "Global 500 2020". Fortune. Retrieved 16 December 2020.

- ^ "TEN wins long-term suezmax charter with an oil major". Lloyds List. 1 December 2015. Retrieved 6 December 2015.

Cite error: There are <ref group=lower-alpha> tags or {{efn}} templates on this page, but the references will not show without a {{reflist|group=lower-alpha}} template or {{notelist}} template (see the help page).