Back نموذج تقييم الأصول الرأسمالية Arabic Model de valoració d'actius financers Catalan CAPM Czech Capital asset pricing model Danish Capital Asset Pricing Model German Modelo de valoración de activos financieros Spanish Aktibo finantzarioen balorazio eredu Basque مدل قیمتگذاری داراییهای سرمایهای Persian Capital Asset Pricing -malli Finnish Modèle d'évaluation des actifs financiers French

This article needs additional citations for verification. (April 2021) |

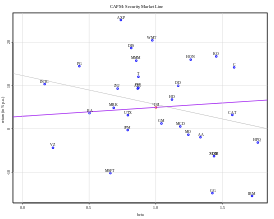

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio.

The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost of equity capital is determined only by beta.[1][2] Despite its failing numerous empirical tests,[3] and the existence of more modern approaches to asset pricing and portfolio selection (such as arbitrage pricing theory and Merton's portfolio problem), the CAPM still remains popular due to its simplicity and utility in a variety of situations.

- ^ https://www.nobelprize.org/uploads/2018/06/sharpe-lecture.pdf [bare URL PDF]

- ^ James Chong; Yanbo Jin; Michael Phillips (April 29, 2013). "The Entrepreneur's Cost of Capital: Incorporating Downside Risk in the Buildup Method" (PDF). Retrieved 25 June 2013.

- ^ Fama, Eugene F; French, Kenneth R (Summer 2004). "The Capital Asset Pricing Model: Theory and Evidence". Journal of Economic Perspectives. 18 (3): 25–46. doi:10.1257/0895330042162430.