| This article is part of a series on the |

| Budget and debt in the United States of America |

|---|

|

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

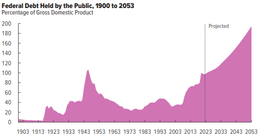

CBO reported in July 2014 that the continuation of present tax and spending policies for the long-run (into the 2030s) results in a budget trajectory that causes debt to grow faster than GDP, which is "unsustainable." Further, CBO reported that high levels of debt relative to GDP may pose significant risks to economic growth and the ability of lawmakers to respond to crises. These risks can be addressed by higher taxes, reduced spending, or combination of both.[1]

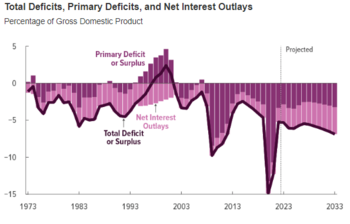

The U.S. reported budget surpluses in only four years between 1970–2020, during fiscal years 1998–2001, the last four years budgeted by President Bill Clinton. These surpluses are attributed to a combination of a booming economy, higher taxes implemented in 1993, spending restraint, and capital gains tax revenues.[2]

CBO estimated in February 2023 that Federal debt held by the public is projected to rise from 98 percent of GDP in 2023 to 118 percent in 2033—an average increase of 2 percentage points per year. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2033, pushing federal debt higher still, to 195 percent of GDP in 2053.[3]

Economists debate the extent to which deficits and debt present a problem, and the best timing and approach for reducing them. For example, Keynes argued that the time for austerity (deficit reduction through tax increases and spending cuts) was during a booming economy, while increasing the deficit is the right policy prescription during a slump (recession). During the pandemic recession of 2020, several economists argued that deficits and debt reduction were not priorities.[4]

CBO estimated that the U.S. will have a post-WW2 record budget deficit of nearly $4 trillion in fiscal year 2020 (17.9% GDP), due to measures to combat the coronavirus pandemic.[5]

- ^ CBO Long-Term Budget Outlook. July 15, 2014

- ^ "The Budget and Deficit Under Clinton". February 3, 2008 – via factcheck.org.

- ^ "The Budget and Economic Outlook: 2023 to 2033". CBO. February 15, 2023. Retrieved February 1, 2024.

- ^ Jacobson, Lindsey (21 September 2020). "Here's why top economists are not worried about the national debt, now worth over $26 trillion". cnbc.com.

- ^ "CBO's Current Projections of Output, Employment, and Interest Rates and a Preliminary Look at Federal Deficits for 2020 and 2021". April 24, 2020 – via cbo.gov.