Back أزمة الديون الأوروبية Arabic Crisis del euru AST Еўрапейскі даўгавы крызіс Byelorussian Дългова криза в еврозоната Bulgarian ইউরোপীয় ঋণ সংকট Bengali/Bangla Crisi de la zona euro Catalan Dluhová krize v eurozóně Czech Eurokrise German Κρίση της Ευρωζώνης Greek Eŭropa financa krizo de 2010 Esperanto

It has been suggested that Controversies surrounding the eurozone crisis be merged into this article. (Discuss) Proposed since August 2024. |

This article may be too long to read and navigate comfortably. When this tag was added, its readable prose size was 20,000 words. (January 2024) |

| Part of a series on the |

| Great Recession |

|---|

| Timeline |

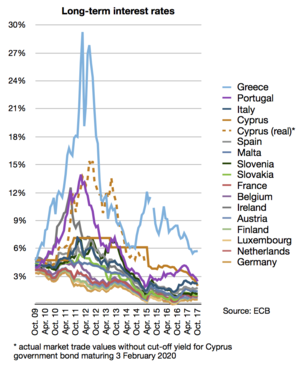

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, was a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone member states (Greece, Portugal, Ireland and Cyprus) were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).

The eurozone was caused by a sudden stop of the flow of foreign capital into countries that had substantial current account deficits and were dependent on foreign lending. The crisis was worsened by the inability of states to resort to devaluation (reductions in the value of the national currency) due to having the Euro as a shared currency.[3][4] Debt accumulation in some eurozone members was in part due to macroeconomic differences among eurozone member states prior to the adoption of the euro. It also involved a process of debt market contagion. The European Central Bank adopted an interest rate that incentivized investors in Northern eurozone members to lend to the South, whereas the South was incentivized to borrow because interest rates were very low. Over time, this led to the accumulation of deficits in the South, primarily by private economic actors.[3][4] A lack of fiscal policy coordination among eurozone member states contributed to imbalanced capital flows in the eurozone,[3][4] while a lack of financial regulatory centralization or harmonization among eurozone states, coupled with a lack of credible commitments to provide bailouts to banks, incentivized risky financial transactions by banks.[3][4] The detailed causes of the crisis varied from country to country. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. European banks own a significant amount of sovereign debt, such that concerns regarding the solvency of banking systems or sovereigns are negatively reinforcing.[5]

The onset of crisis was in late 2009 when the Greek government disclosed that its budget deficits were far higher than previously thought.[3] Greece called for external help in early 2010, receiving an EU–IMF bailout package in May 2010.[3] European nations implemented a series of financial support measures such as the European Financial Stability Facility (EFSF) in early 2010 and the European Stability Mechanism (ESM) in late 2010. The ECB also contributed to solve the crisis by lowering interest rates and providing cheap loans of more than one trillion euro in order to maintain money flows between European banks. On 6 September 2012, the ECB calmed financial markets by announcing free unlimited support for all eurozone countries involved in a sovereign state bailout/precautionary programme from EFSF/ESM, through some yield lowering Outright Monetary Transactions (OMT).[6] Ireland and Portugal received EU-IMF bailouts In November 2010 and May 2011, respectively.[3] In March 2012, Greece received its second bailout. Both Cyprus received rescue packages in June 2012.[3]

Return to economic growth and improved structural deficits enabled Ireland and Portugal to exit their bailout programmes in July 2014. Greece and Cyprus both managed to partly regain market access in 2014. Spain never officially received a bailout programme. Its rescue package from the ESM was earmarked for a bank recapitalisation fund and did not include financial support for the government itself. The crisis had significant adverse economic effects and labour market effects, with unemployment rates in Greece and Spain reaching 27%,[7] and was blamed for subdued economic growth, not only for the entire eurozone but for the entire European Union. The austerity policies implemented as a result of the crisis also produced a sharp rise in poverty levels and a significant increase in income inequality across Southern Europe.[8] It had a major political impact on the ruling governments in 10 out of 19 eurozone countries, contributing to power shifts in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as outside of the eurozone in the United Kingdom.[9]

- ^ "Long-term interest rate statistics for EU Member States". ECB. 12 July 2011. Retrieved 22 July 2011.

- ^ Wearden, Graeme (20 September 2011). "EU debt crisis: Italy hit with rating downgrade". The Guardian. UK. Retrieved 20 September 2011.

- ^ a b c d e f g h Cite error: The named reference

Copelovitch-2016was invoked but never defined (see the help page). - ^ a b c d Cite error: The named reference

Frieden-2017was invoked but never defined (see the help page). - ^ Seth W. Feaster; Nelson D. Schwartz; Tom Kuntz (22 October 2011). "It's All Connected: A Spectators Guide to the Euro Crisis". The New York Times. New York. Retrieved 14 May 2012.

- ^ "Technical features of Outright Monetary Transactions", European Central Bank Press Release, 6 September 2012

- ^ "Eurozone unemployment at record high in May". CBS News. 1 July 2013. Archived from the original on 27 September 2013. Retrieved 6 July 2013.

- ^ last1: Perez (2017). "The Political Economy of Austerity in Southern Europe". New Political Economy. 23 (2): 192–207. doi:10.1080/13563467.2017.1370445. hdl:11311/1034637.

{{cite journal}}: CS1 maint: numeric names: authors list (link) - ^ Chiara Casi (January 2019). "Bail in -la gestione delle crisi bancarie". Bail in e la Nuova Gestione delle Crisi Bancarie. Retrieved 6 October 2019.