Back بطاقة الدفع Arabic Аплатная картка Byelorussian Аплатная картка BE-X-OLD Банкова карта Bulgarian पेमेंट कार्ड Bihari Targeta de pagament Catalan Platební karta Czech Betalingskort Danish Zahlungskarte German Monkarto Esperanto

| Part of a series on financial services |

| Banking |

|---|

|

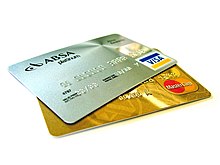

- Issuing bank logo

- EMV chip

- Hologram

- Card number

- Card brand logo

- Expiration date

- Cardholder's name

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner (the cardholder) to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs).[1] Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

There are a number of types of payment cards, the most common being credit cards, debit cards, charge cards, and prepaid cards. Most commonly, a payment card is electronically linked to an account or accounts belonging to the cardholder. These accounts may be deposit accounts or loan or credit accounts, and the card is a means of authenticating the cardholder. However, stored-value cards store money on the card itself and are not necessarily linked to an account at a financial institution.

It can also be a smart card that contains a unique card number and some security information such as an expiration date or with a magnetic strip on the back enabling various machines to read and access information.[2] Depending on the issuing bank and the preferences of the client, this may allow the card to be used as an ATM card, enabling transactions at automatic teller machines; or as a debit card, linked to the client's bank account and able to be used for making purchases at the point of sale; or as a credit card attached to a revolving credit line supplied by the bank. In 2017, there were 20.48 billion payments cards (mainly prepaid cards) in the world.[3]

- ^ a b About-Payments.com – Card Payments, archived from the original on 2015-11-20, retrieved 2014-05-30

- ^ Wonglimpiyara, Jarunee (1 March 2005). Strategies of Competition in the Bank Card Business. Sussex Academic Press. p. vi. ISBN 978-1903900550.

- ^ https://nilsonreport.com/publication_chart_and_graphs_archive.php?1=1&year=2018 Archived 2022-10-24 at the Wayback Machine. Retrieved October 24, 2022.