Back فرضية الدخل الدائم Arabic Hypotéza permanentního důchodu Czech Hypothese permanenter Einkommen German Hipótesis del ingreso permanente Spanish فرضیه درآمد دائمی Persian Pysyvän tulotason hypoteesi Finnish Théorie du revenu permanent French 항상소득 가설 Korean Permanente inkomenshypothese Dutch Hipoteza dochodu permanentnego Polish

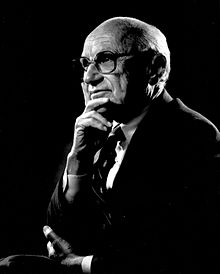

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing.[α] The theory was developed by Milton Friedman and published in his A Theory of the Consumption Function, published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption.

The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Keynesian orthodoxy. Friedman's predictions of consumption smoothing, where people spread out transitory changes in income over time, departed from the traditional Keynesian emphasis on a higher marginal propensity to consume[β] out of current income.

Income consists of a permanent (anticipated and planned) component and a transitory (unexpected and surprising) component. In the permanent income hypothesis model, the key determinant of consumption is an individual's lifetime income, not their current income. Unlike permanent income, transitory incomes are volatile.

Cite error: There are <ref group=lower-greek> tags on this page, but the references will not show without a {{reflist|group=lower-greek}} template (see the help page).

- ^ Mankiw & Taylor 2006, p. 870.