Back Méthode de quasi-Monte-Carlo French 준몬테카를로 방법 Korean Метод квазі-Монте-Карло Ukrainian 拟蒙特卡罗方法 Chinese

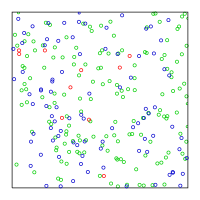

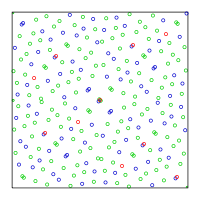

In numerical analysis, the quasi-Monte Carlo method is a method for numerical integration and solving some other problems using low-discrepancy sequences (also called quasi-random sequences or sub-random sequences) to achieve variance reduction. This is in contrast to the regular Monte Carlo method or Monte Carlo integration, which are based on sequences of pseudorandom numbers.

Monte Carlo and quasi-Monte Carlo methods are stated in a similar way. The problem is to approximate the integral of a function f as the average of the function evaluated at a set of points x1, ..., xN:

Since we are integrating over the s-dimensional unit cube, each xi is a vector of s elements. The difference between quasi-Monte Carlo and Monte Carlo is the way the xi are chosen. Quasi-Monte Carlo uses a low-discrepancy sequence such as the Halton sequence, the Sobol sequence, or the Faure sequence, whereas Monte Carlo uses a pseudorandom sequence. The advantage of using low-discrepancy sequences is a faster rate of convergence. Quasi-Monte Carlo has a rate of convergence close to O(1/N), whereas the rate for the Monte Carlo method is O(N−0.5).[1]

The Quasi-Monte Carlo method recently became popular in the area of mathematical finance or computational finance.[1] In these areas, high-dimensional numerical integrals, where the integral should be evaluated within a threshold ε, occur frequently. Hence, the Monte Carlo method and the quasi-Monte Carlo method are beneficial in these situations.

![{\displaystyle \int _{[0,1]^{s}}f(u)\,{\rm {d}}u\approx {\frac {1}{N}}\,\sum _{i=1}^{N}f(x_{i}).}](https://wikimedia.org/api/rest_v1/media/math/render/svg/28359218161a6c30086f6a1bf782ec52f6afedee)