Back البنك الثاني للولايات المتحدة Arabic Second Bank of the United States German Segundo Banco de los Estados Unidos Spanish Estatu Batuetako Bigarren Bankua Basque Second Bank of the United States French Seconda banca degli Stati Uniti d'America Italian 第二合衆国銀行 Japanese 미국 제2은행 Korean Drugi Bank Stanów Zjednoczonych Polish Segundo Banco dos Estados Unidos Portuguese

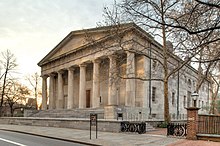

The north façade of the bank on Chestnut Street | |

| Company type | Public–private partnership |

|---|---|

| Industry | Banking |

| Founded | 1816 |

| Defunct |

|

| Fate | Liquidated |

| Headquarters | Philadelphia, Pennsylvania, U.S. |

Key people |

|

The Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, the bank was chartered from February 1816 to January 1836.[1] The bank's formal name, according to section 9 of its charter as passed by Congress, was "The President, Directors, and Company, of the Bank of the United States".[2] While other banks in the US were chartered by and only allowed to have branches in a single state, it was authorized to have branches in multiple states and lend money to the US government.

A private corporation with public duties, the bank handled all fiscal transactions for the U.S. government, and was accountable to Congress and the U.S. Treasury. Twenty percent of its capital was owned by the federal government, the bank's single largest stockholder.[3][4] Four thousand private investors held 80 percent of the bank's capital, including three thousand Europeans. The bulk of the stocks were held by a few hundred wealthy Americans.[5] In its time, the institution was the largest monied corporation in the world.[6]

The essential function of the bank was to regulate the public credit issued by private banking institutions through the fiscal duties it performed for the U.S. Treasury, and to establish a sound and stable national currency.[7][8] The federal deposits endowed the bank with its regulatory capacity.[1][9]

Modeled on Alexander Hamilton's First Bank of the United States,[10] the Second Bank was chartered by President James Madison, who in 1791 had attacked the First Bank as unconstitutional, in 1816 and began operations at its main branch in Philadelphia on January 7, 1817,[11][12] managing 25 branch offices nationwide by 1832.[13]

The efforts to renew the bank's charter put the institution at the center of the general election of 1832, in which the bank's president Nicholas Biddle and pro-bank National Republicans led by Henry Clay clashed with the "hard-money"[14][15] Andrew Jackson administration and eastern banking interests in the Bank War.[16][17] Failing to secure recharter, the Second Bank became a private corporation in 1836,[1][18] and underwent liquidation in 1841.[19] There would not be national banks again until the passage of the National Bank Act.

- ^ a b c Hammond 1947, p. 155.

- ^ Hall & Clarke 1832, p. 625.

- ^ Cite error: The named reference

Hammond, 1947, p. 149was invoked but never defined (see the help page). - ^ Dangerfield 1966, p. 12.

- ^ Hofstadter 1948, pp. 60–61.

- ^ Hammond 1956, p. 102.

- ^ Hammond 1947, pp. 149–150.

- ^ Dangerfield 1966, pp. 10–11.

- ^ Hammond 1956, p. 9.

- ^ Remini 1993, p. 140.

- ^ Wilentz 2005, p. 205.

- ^ Remini 1993, p. 145.

- ^ Wilentz 2005, p. 365.

- ^ Meyers 1953, pp. 212–213.

- ^ Schlesinger 1945, pp. 115–116.

- ^ Hammond 1956, p. 100.

- ^ Hammond 1957, p. 359.

- ^ Wilentz 2005, p. 401.

- ^ Hammond 1947, p. 157.