Back Deuda nacional del Reino Unido Spanish Dette publique du Royaume-Uni French Storbritanniens statsskuld Swedish

This article needs to be updated. (April 2021) |

| This article is part of a series on |

| Politics of the United Kingdom |

|---|

|

|

|

The United Kingdom national debt is the total quantity of money borrowed by the Government of the United Kingdom at any time through the issue of securities by the British Treasury and other government agencies.

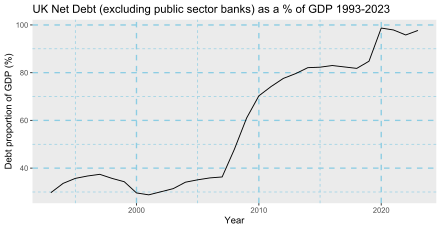

At the end of March 2023, UK general government gross debt was £2,537.0 billion, or 100.5% gross domestic product.[2]

Approximately a third of the UK national debt is owned by the British government due to the Bank of England's quantitative easing programme, so approximately a third of the cost of servicing the debt is paid by the government to itself. In 2018, this reduced the annual servicing cost to approximately £30 billion (approx 2% of GDP, approx 5% of UK government tax income).

In 2017, due to the Government's budget deficit (PSNCR), the national debt increased by £46 billion.[3] The Cameron–Clegg coalition government in 2010 planned that they would eliminate the deficit by the 2015/16 financial year.[4] However, by 2014 they admitted that the structural deficit would not be eliminated until the financial year 2017/18.[5] This forecast was pushed back to 2018/19 in March 2015, and to 2019/20 in July 2015,[6] before the target of a return to surplus at any particular time was finally abandoned by the then Chancellor of the Exchequer George Osborne in July 2016.[7]

- ^ "PS: Net Debt (excluding public sector banks) as a % of GDP: NSA - Office for National Statistics". www.ons.gov.uk. Retrieved 16 January 2020.

- ^ "UK government debt and deficit: March 2023". Office for National Statistics. Retrieved 19 August 2023.

- ^ Lewiss1. "Public sector finances, UK - Office for National Statistics". Ons.gov.uk. Retrieved 5 November 2018.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ "George Osborne has failed in his deficit reduction ambitions – and the Tories are likely to pay a price at the ballot box". Independent.co.uk. 27 July 2014.

- ^ Mason, Rowena (10 February 2014). "Clegg backs Osborne's timetable for eliminating UK's structural deficit". The Guardian. Retrieved 5 November 2018.

- ^ Liam Halligan (11 July 2015). "George Osborne's savvy display lacked tough fiscal action". Daily Telegraph. Retrieved 12 July 2015.

- ^ Emily Cadman; Gemma Tetlow (1 July 2016). "George Osborne abandons 2020 UK surplus target". Financial Times. Retrieved 23 July 2016.