Back ولز فارجو Arabic ولز فارقو AZB Wells Fargo Catalan Wells Fargo Czech Wells Fargo Danish Wells Fargo German Wells Fargo Esperanto Wells Fargo Spanish Wells Fargo Estonian Wells Fargo Basque

Company logo since 2019 | |

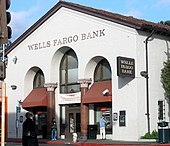

Wells Fargo's office in San Francisco, California | |

| Company type | Public |

|---|---|

| ISIN | US9497461015 |

| Industry | |

| Predecessors | |

| Founded | January 24, 1929 in Minneapolis, Minnesota, U.S. (as Northwest Bancorporation) April 1983 (as Norwest Corporation) November 2, 1998 (as Wells Fargo & Company) |

| Founders | (Wells Fargo Bank) |

| Headquarters | Sioux Falls, South Dakota, U.S. (legal)[1] 420 Montgomery Street[2][3] San Francisco, California (corporate)[4] 30 Hudson Yards[5] New York, NY 10001 U.S. (executive)[6][7] |

Number of locations | |

Area served | Worldwide |

Key people | |

| Products | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 238,698 (2022) |

| Subsidiaries | |

| Website | wellsfargo.com |

| Footnotes / references [8] | |

Wells Fargo & Company is an American multinational financial services company with a significant global presence.[11][8] The company operates in 35 countries and serves over 70 million customers worldwide.[8] It is a systemically important financial institution according to the Financial Stability Board, and is considered one of the "Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup.[12]

The company's primary subsidiary is Wells Fargo Bank, N.A., a national bank that designates its Sioux Falls, South Dakota, site as its main office (and therefore is treated by most U.S. federal courts as a citizen of South Dakota).[1] It is the fourth-largest bank in the United States by total assets and is also one of the largest as ranked by bank deposits and market capitalization. It has 8,050 branches and 13,000 automated teller machines[8] and 2,000 stand-alone mortgage branches. It is the second-largest retail mortgage originator in the United States, originating one out of every four home loans[13] and services $1.8 trillion in home mortgages, one of the largest servicing portfolios in the U.S.[8] It is one of the most valuable bank brands.[14][15] Wells Fargo is ranked 47th on the Fortune 500 list of the largest companies in the U.S.[16]

In addition to banking, the company provides equipment financing via subsidiaries including Wells Fargo Rail and provides investment management and stockbrokerage services. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services.[17][18][19][20] This led to the Wells Fargo cross-selling scandal.

Wells Fargo has international offices in London, Dublin, Paris, Dubai, Singapore, Tokyo, Shanghai, Beijing, and Toronto, among others.[21] Back-offices are in India and the Philippines with more than 20,000 staff.[22] Notably, Wells Fargo is the first major national U.S. bank to undergo a successful unionization drive.[23] As of October 2024, 20 branch locations have joined Wells Fargo Workers United-CWA, a division of Communications Workers of America in less than a year.[24]

Wells Fargo operates under Charter No. 1, the first national bank charter issued in the United States. This charter was issued to First National Bank of Philadelphia on June 20, 1863, by the Office of the Comptroller of the Currency.[25] Wells Fargo, in its present form, is a result of a merger between the original Wells Fargo & Company and Minneapolis-based Norwest Corporation in 1998. The merged company took the better-known Wells Fargo name and moved to Wells Fargo's hub in San Francisco. At the same time, Norwest's banking subsidiary merged with Wells Fargo's Sioux Falls-based banking subsidiary. Wells Fargo became a coast-to-coast bank with the 2008 acquisition of Charlotte-based Wachovia.

- ^ a b Rouse v. Wachovia Mortgage, FSB, 747 F.3d 707 (9th Cir. 2014) (citing cases on each side of circuit split and joining majority rule that a national bank is only a citizen of the state in which its main office is located).

- ^ "Mailing Addresses". WellsFargo. Retrieved May 26, 2024.

- ^ "Wells Fargo & Co Company Profile - Overview". GlobalData. Retrieved May 26, 2024.

- ^ "Locations - A World of Opportunity". Wells Fargo. Retrieved May 26, 2024.

- ^ a b "Newsroom Wells Fargo Announces Expansion at Hudson Yards". New York: Wells Fargo. November 27, 2023. Retrieved March 17, 2024.

- ^ a b Wack, Kevin (February 26, 2020). "How New York became Wells Fargo's new center of power". American Banker.

- ^ a b "Wells Fargo Manhattan Headquarters". Retrieved June 11, 2023.

- ^ a b c d e "Wells Fargo & Company Annual Report 2022" (PDF). wellsfargo.com. Wells Fargo.

- ^ O'Daniel, Adam (November 1, 2012). "Wells Fargo to open new Charlotte trading floor in Duke Energy Center". American City Business Journals.

- ^ "PHOTOS: First look at Wells Fargo Securities' new trading floor". American City Business Journals. November 29, 2012.

- ^ Wack, Kevin (February 26, 2020). "How New York became Wells Fargo's new center of power". American Banker.

- ^ "FRB: Large Commercial Banks".

- ^ Fox, Zach; Gull, Zuhaib (July 16, 2020). "Quicken overtakes Wells Fargo as nation's No. 1 mortgage originator". S&P Global.

- ^ Gray, Melinda (February 7, 2014). "Wells Fargo Tops List of World's Most Valuable Bank Brands". Chicago Agent.

- ^ "The Top 500 Banking Brands, 2014". The Banker. February 3, 2014.

- ^ "Fortune 500: Wells Fargo". Fortune.

- ^ Tayan, Brian (December 19, 2016). "The Wells Fargo Cross-Selling Scandal". Harvard Law School.

- ^ Egan, Matt (January 13, 2017). "Wells Fargo dumps toxic 'cross-selling' metric". CNN.

- ^ Smith, Randall (February 28, 2011). "In Tribute to Wells, Banks Try the Hard Sell". The Wall Street Journal.

- ^ Touryalai, Halah (January 25, 2012). "The Art Of The Cross-Sell". Forbes.

- ^ "International Locations". January 12, 2024.

- ^ "Why US banking giant Wells Fargo is creating back-office jobs in India". Firstpost. June 22, 2012.

- ^ "Union drive at Wells Fargo heats up as employees allege intimidation tactics". Firstpost. October 17, 2024.

- ^ "Wells Fargo Workers Win First-Ever Union Election". Firstpost. December 20, 2023.

- ^ Babal, Marianne (March 14, 2019). "Charter Number 1". Wells Fargo.